Listen on the go!

In recent times, machines are getting smarter across the globe. The thriving power of Artificial Intelligence is making it possible for industries to become intelligent and serve their customers in a better manner. The role of AI and chatbots in banking is undeniable.

Digital agent assistants and chatbots have revolutionized personalized banking and customer services. They have catered to rapid processing needs, unique customer requirements, secured data management, and round the clock availability.

Most of the banks have started embracing AI and related technologies worldwide. As per the survey by National Business Research Institute, over 32 percent of financial institutions use AI by the means of voice recognition and predictive analysis.

Also Read: AI-rich Virtual Assistants Set to Unleash a New Era of Digital Banking Experience |

Most Noteworthy Use Cases of Chatbot Implementation to Enhance Banking Services

Banking is one of the most rapidly growing sectors today where a large number of complex transactions take place 24X7 across the world. Artificial intelligence is the key to automation and simplifying the banking processes that can help achieve enhanced customer experience.

AI enabled chatbots enhance Customer Services

Improving customer service and making conversational banking a reality is the sole aim of implementing AI in Banking. Chatbots are nothing but automated AI-powered customer service agents that gather customer data, apply machine learning to analyze the data, and then provide the relevant information to the customers. Chatbots can also provide feedback and suggestions on wealth management and other services analyzing customer behavior. It also helps customers in financial planning, keeping a record of expenditure and income, etc.

Chatbots improve efficiency and reduce the workload

A well-implemented chatbot acts as a virtual agent and answering machine to serve customers continuously round the clock. It can handle all kinds of queries and channelize them to the right agent or banking website when necessary. When compared to traditional IVR systems, chatbots instantly help in basic banking tasks such as opening and closing of accounts, fund transfers, etc. When the need of the hour is instant connectivity and gratification, chatbots are here to immensely reduce workload and improve the efficiency of banking operations.

Also Read: Why are Banks So Excited About Virtual Assistants |

Drive banking business efficiently

Wealth management and portfolio management can be done effectively and efficiently with AI. It can bring ‘banking at your fingertips’ for the users who just hate to visit the banks. It strengthens the mobile banking facility by managing basic banking services. Customers can get the benefits of automated and safe transactions. They get notification instantly for any suspicious transaction as per their usual patterns.

Another useful application of AI is a card management system. It not only automates the credit and debit card management system but also makes it safer. It helps the customer get rid of a long authentication process in the case of losing the card. The AI system saves time and efforts of the customers and in a way, improves mobile banking services.

Greater mitigation of risks

AI-powered chatbots can handle and simplify the process of analyzing important data pertaining to the loan of prospective customers, market trends, and the latest financial activities of the borrower, derive credit reports and give advice on potential risks. Chatbots minimize human errors in identifying fraud and makes processes smooth.

Also Read: 5 Ways Chatbots Can Help Retail Banking Sustain Next Big Recession |

In a Nutshell

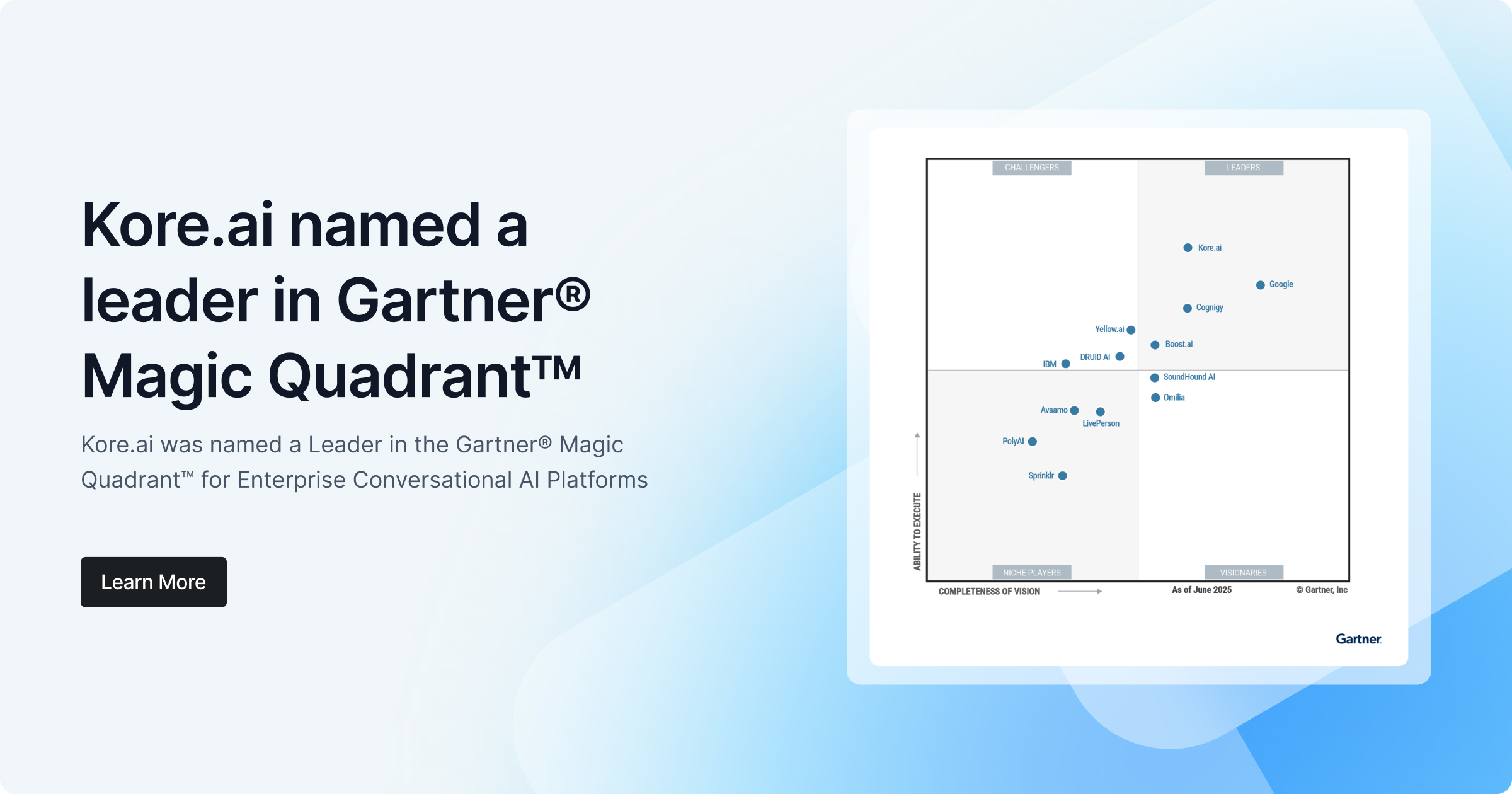

AI has the power to revolutionize banking in the coming days and transform the future of conversational banking. Kore.ai is one of the reckoned names worldwide in leveraging the power of Artificial Intelligence, Machine Learning, and Natural Language Processing to provide chatbot platform that can be customized to the needs of the customers in the most cost-effective way.

Read our expertize in Banking to know more

|

Talk to us to explore unlimited AI-enabled chatbots use cases in banking  |

Build virtual assistants for FREE and publish on your preferred channel NOW. |