Digital transformation is at the heart of every bank as technology has become the key factor to delivering a superior customer experience. Global banking giants are leading the way in leveraging technology for mapping customer expectations, understanding their needs and offering highly personalized set of products and services. Banks that have the best customer relationship models are deploying artificial intelligence (AI)-driven chatbots and analytics to reduce costs, improve efficiency, and enhance the overall experience.

Chatbots in banking gain prominence

By 2020, global analyst firm Gartner estimates that customers will manage 85% of their relationships with an enterprise without interacting with a human. Mobile apps may become passe with 20% of brands abandoning them altogether (by 2019 per Gartner), even as conversational UI takes its place as the preferred mode of customer engagement.

There is evidence already that a rising number of customers, especially millennials, are preferring AI-powered bots to humans for financial advice and decision making. Automation is increasing with the potential to streamline processes, while AI-based business models are changing the way banking products and services are accessed.

Also Read: 5 Ways Chatbots Can Help Retail Banking Sustain Next Big Recession |

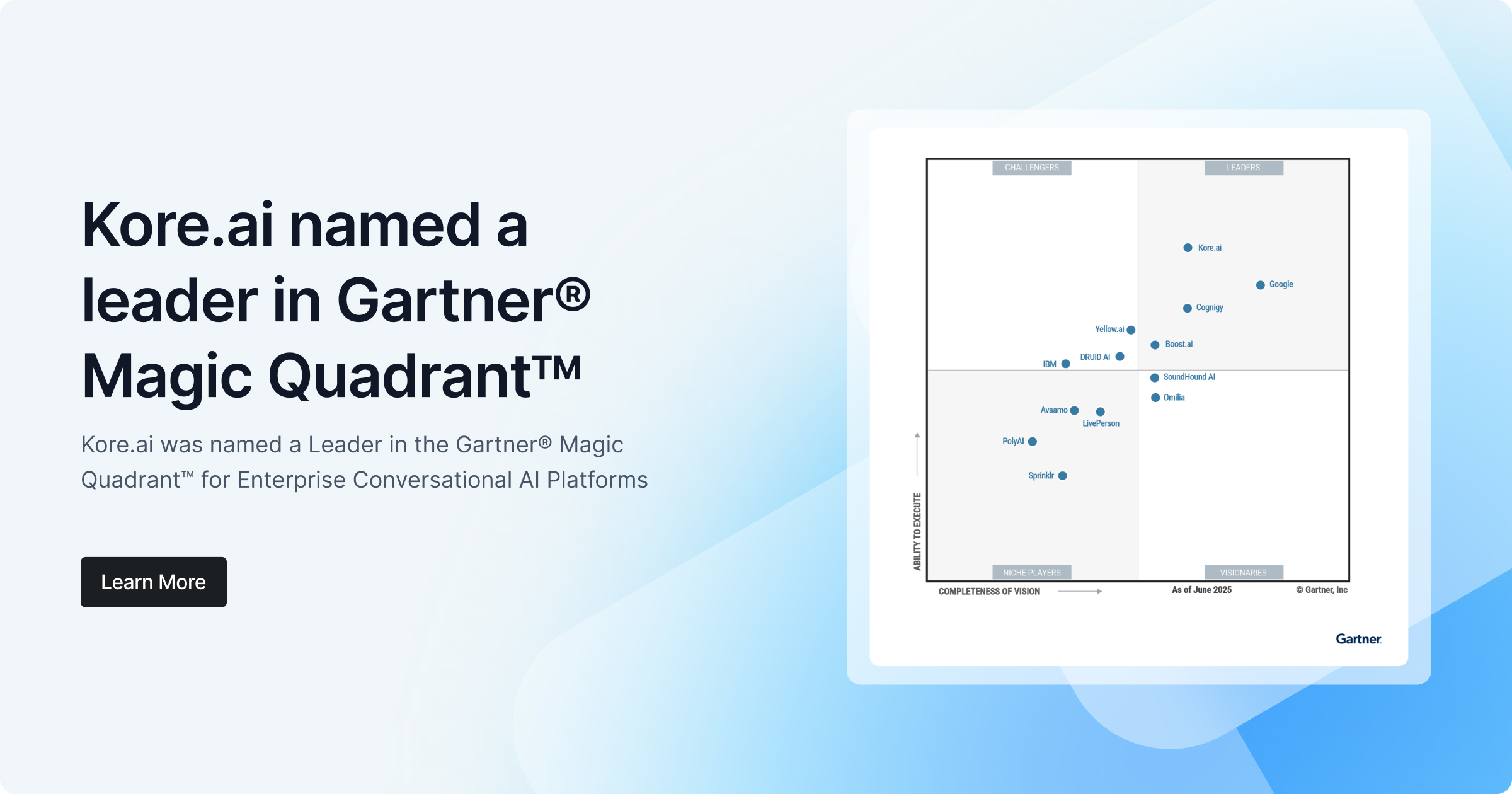

Banks are leveraging conversational interfaces enabled by AI-powered chatbot platforms such as Kore.ai’s to raise the bar of customer experience higher. These platforms also come with one of the most advanced Machine Learning (ML) and Natural Language Processing (NLP) capabilities, enabling banks to mine huge amounts of data and provide highly targeted and personalized offers to customers.

Use cases of chatbots in banking

Banking leaders can derive immense value from chatbots, which offer services that go beyond normal business hours, drive sales, and cultivate loyalty. Some typical use case scenarios for chatbots in banking are:

|

Account balances |

User can check balance in many different ways in natural language from specific accounts or all accounts |

| Transaction history |

Transaction category, time period and value searches

|

| Feedback management | Bots can be trained to ingest product literature and survey questionnaires. Based on specific responses from the users, bots can cover all the questions they need answers for |

|

Bot -Agent handoff |

Kore.ai implemented chatbots that are trained to respond based on the emotional state of customers. Bots perform sentiment analysis and scan emotional behavior to know when to handoff to live agents |

| Search loan products | Bot helps user apply for specific types of loans based on their requirements |

| FAQs | Bot helps user answer FAQs and provides multiple input options |

| ATM and branch locator | Bot helps user find ATM or branch at a specific city or location. Bot helps them filter out results based on facilities like Forex services, disable friendly branch etc |

| Pay bills |

Enable customer to pay bills, add payees and set up recurring payments. Look up upcoming recurring payments |

| Transfers |

Enable customer to transfer money among various accounts – internal or external depending on bank rules |

|

Account opening |

Bot guides user to open new bank or credit card account |

| Actionable alerts |

User set or bank set – opt-in or automatic:

|

| Insurance |

Bot helps user buy insurance for needs, it also remembers the existing policies user owns |

| Credit card search |

Bot helps user identify specific type of credit based on requirement |

| P2P payment |

Bot helps user transfer funds to an existing recipient, and add new recipient before transferring money to them |

| Requests or inquiries |

|

Also Read: How Chatbots Elevate Your Bank's Digital Transformation Efforts |

Request a demo to know how AI driven chatbots bring more banking opportunities and reduce customer service costs.