Banks in the era of digital disruptions are highly reliant on technology to deliver enhanced customer experience. Banking conglomerates across the globe are leveraging the latest technology to reach out in a more personalized manner to customers, know their customized needs, understand expectation and cater the best of the products and banking services.

One such technology that's empowering banking giants is Artificial Intelligence (AI). AI-driven chatbots are the next big thing in conversational banking, helping banks in reducing operational costs, improving efficiency and humanizing experiences for its customers.

A survey conducted online by Harris Poll states - Financial institutions that fail to elevate the digital experience risk losing a significant portion of their customer base, as 32% of digital banking users reports that they are willing to leave their current bank or credit union for a better digital experience.

Also Read: Experience the power of Conversational Banking at Singapore FinTech Festival 2018 |

Adoption of chatbots by financial institutions

According to research from Accenture, around 7 percent of Canadians and 11 percent of Americans switch banks every year.

To build a robust future that can respond to the ever-changing customer expectation and digital landscape, banks and financial institutions, are heavily investing in chatbots to deliver contextual information and act as a human agent to address the right person at the right time and through the preferred channel.

This has helped all the stakeholders involved in the banking scene from CXOs, CFOs to the end customer.

Leveraging the potential of Conversation AI driven chatbots, banks can:

-

Help to automate customer query resolution and collect critical information pertaining to fraud detection and potentially impacted bank users.

-

Push relevant content to end users and analyze user engagement.

-

Lead an organization’s personalized methodology and create incremental income. (ROI)

Also Read: How Chatbots Can Drive Better Customer Engagement for Banks |

Why Conversational AI is so important in banking

Building and launching a successful chatbot can bring a variety of significant benefits to the financial institutions that deploy them. These include being able to:

1. More Efficient Banking

Chatbots enhance efficiency, minimize human errors and resolve customer queries faster. A good banking chatbot, like the one that kore.ai offers can dramatically lighten contact center workloads and meet high-value customer needs in no time.

2. Enable data-driven and analytical banking

Chatbots not only work as virtual banking assistants but they also derive important metrics, analytics on customer behavior, and other important insights on banking transactions. These metrics later assist in building futuristic strategies for achieving increased ROI.

3. Improved customer experience

One of the greatest benefits of having a virtual financial assistant is that it not only allows you to orchestrate conversations with your customers but that it also gives you a vehicle for listening to them at scale. By paying attention to what questions they’re asking, what concerns they have, or any difficulties they’re encountering, you will be in a much better position to create a more effective product offering. Essentially, you’re getting a look directly into how your customers operate and think, which you can then use to craft new offerings, more targeted messaging, and more.

3. Fostering greater engagement.

Most customers want to be in charge of their financial lives. When you empower them to do so — by making it easier for them to access information, initiate transactions, and explore their accounts — it increases their overall satisfaction and makes them more likely to engage with your brand. The result is that you not only free up internal operational resources that had previously been dedicated to servicing these customers, you also drive higher net promoter scores and greater customer loyalty.

4. Improve Financial Knowhow

A banking chatbot or virtual assistant is a great way to impart knowledge on banking related products and services, answering questions, disseminating the right piece of information to the right audience. Artificial intelligence and NLP enabled chatbots brings together customers regardless of where they are located and help solve their needs. Chatbots are the tool for scalable and future proof banking.

Also Read: Why Millennial Customers Are Pushing Banks To Take Digital Investments The Extra Step |

Conversational banking in recent times

In 2017, American Express announced about their decision to integrate Amazon’s Echo to enable customers to check their balance, view offers, make transactions and experience new age banking.

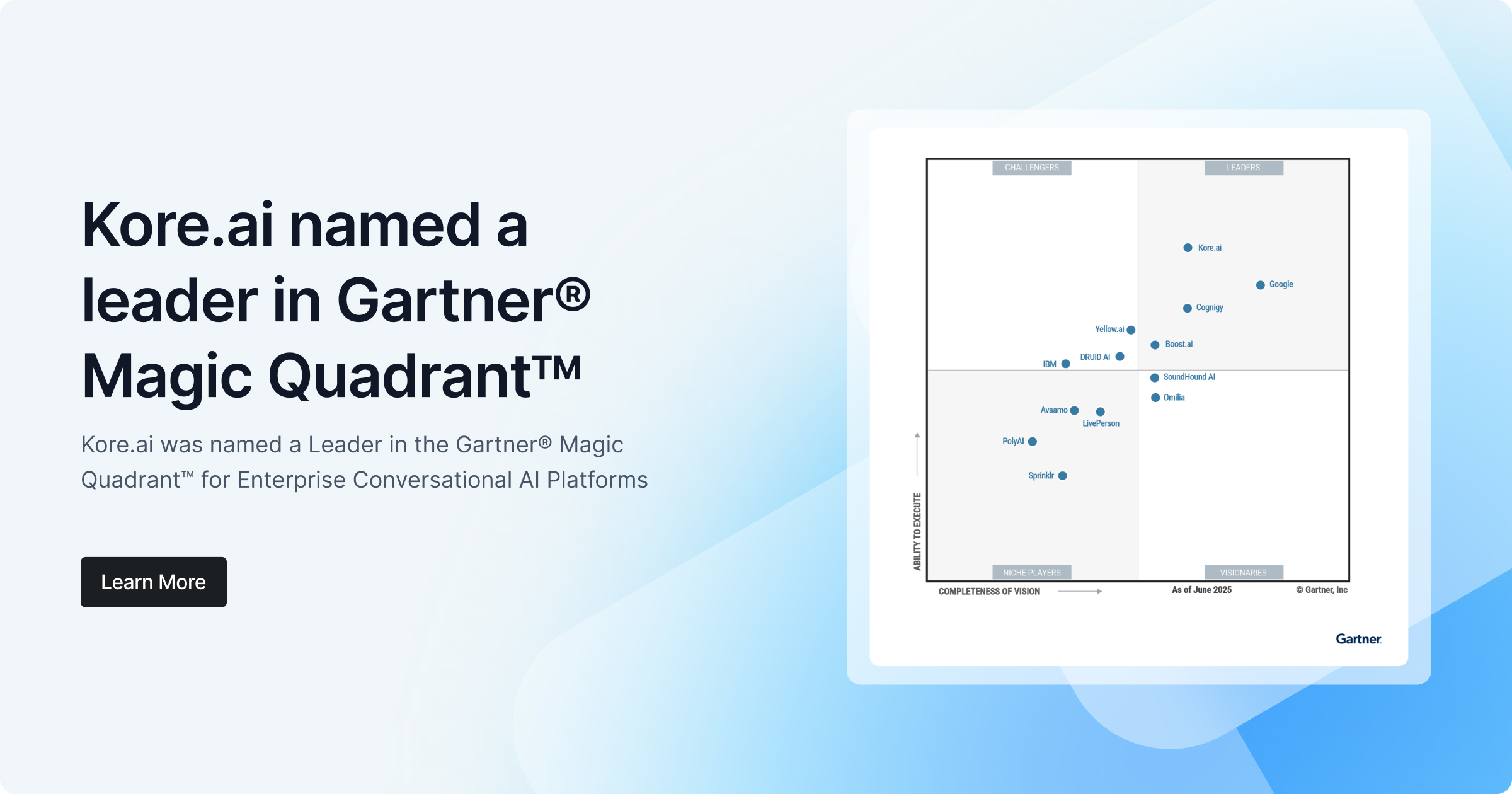

Banks are leveraging conversational interfaces enabled by AI-powered chatbot platforms such as Kore.ai’s to raise the bar of customer experience higher. These platforms also come with one of the most advanced Machine Learning (ML) and Natural Language Processing (NLP) capabilities, enabling banks to mine huge amounts of data and provide highly targeted and personalized offers to customers.

According to a report released by Gartner, consumers will manage 85% of the total business associations with banks through Fintech chatbots by 2020.

The road ahead

Conversational banking is the future of the banking industry. They’re a way to increase efficiency, gather insights, foster engagement, and help customers achieve greater financial success. But to benefit from this technology, you need to have a strategic approach to launching, managing, and maintaining them. In a nutshell, you need a robust chatbot strategy.

Companies like Kore.ai help you in this insightful journey of digital transformation embracing conversational banking to interact and reach out to customers in the way they want.