AI is in every boardroom conversation, and enterprise leaders everywhere are feeling the pressure to get it right. But as adoption speeds up, so do the questions.

Which use cases are delivering real results? How are organizations balancing speed with governance? Are most building from scratch, buying off the shelf, or finding a middle path? And most importantly, what’s actually working in practice for global enterprises?

The Kore.ai “Practical Insights from AI Leaders – 2025” report brings clarity to the noise.

Drawing insights from over 1000+ enterprise leaders across industries and regions, it paints a real picture of what AI experimentation and adoption look like in 2025, not just in headlines, but on the ground.

In this blog, you’ll get a peek into what’s top of mind for global AI leaders - the priorities, challenges, investments, and talent strategies shaping the next phase of enterprise AI.

Let’s dive in 👇

(About the report:

Surveyed in March 2025 by Paradoxes and supported by Kore.ai, ‘Practical Insights from AI Leaders – 2025’ reveals how enterprise leaders are adopting AI, tackling challenges, investing budgets, and driving innovation to reshape business and gain a competitive edge.

The survey gathered insights from over 1000 senior business and technology leaders across 12 countries, including the U.S., UK, Germany, UAE, India, Singapore, Philippines, Japan, Korea, Australia, and New Zealand.)

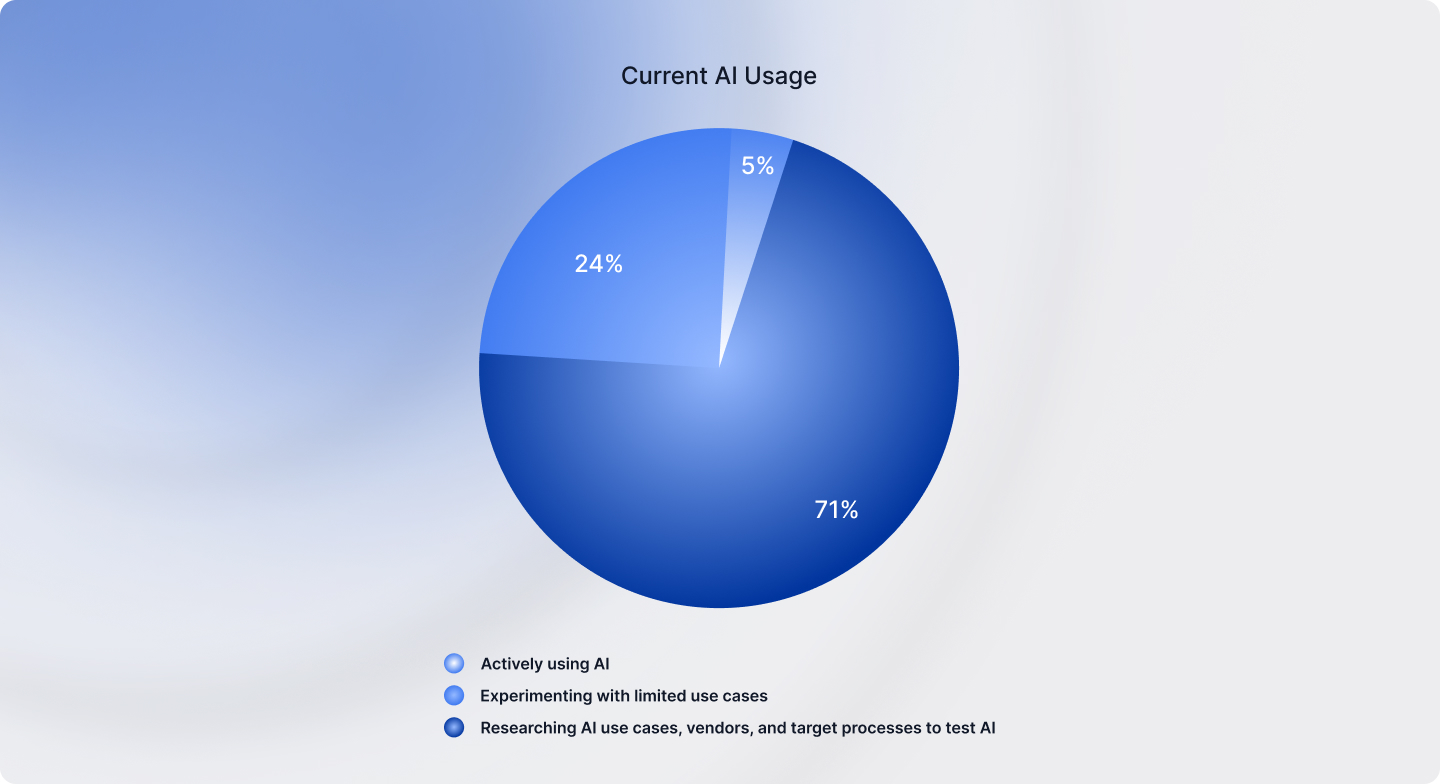

How Deep AI Adoption Runs Across Enterprises?

Enterprises are experimenting with AI across multiple functional areas, but often in silos. What’s missing is a cohesive strategy to scale AI impact across the business.

According to the Kore.ai survey, 71% of enterprise leaders report that their organizations are actively using or piloting AI across multiple departments, like customer support, IT, HR, finance, operations, and marketing.

This surge in adoption aligns with Gartner's forecast that, by 2026, more than 80% of enterprises will have deployed generative AI applications in production, a dramatic rise from less than 5% in early 2023.

The survey shows that use cases specific to IT support, customer service, and marketing lead in AI automation. Product, HR, finance, operations, and engineering show strong uptake, while functions like admin, procurement, legal, and sales remain in early or experimental stages.

Regionally, North America (79%), Western Europe (70%), and India (87%) lead in AI adoption, driven by strong executive support. In contrast, parts of APAC, particularly Japan (56%), South Korea (64%), and Southeast Asia (59%), show a slower uptake, reflecting more cautious leadership.

With AI adoption accelerating worldwide, the next question is clear: Which use cases are driving leaders to double down on AI?

What’s Fueling The AI Agenda In The C-Suite?

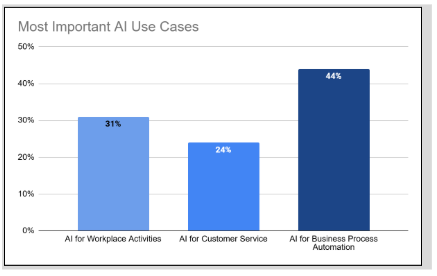

Across boardrooms, the AI conversation is shifting from ‘why’ to ‘where next’. The research highlights that most leaders are focusing on use cases today that deliver tangible business value:

1. 44% are applying AI for process automation, covering areas like compliance, risk management, and workflow optimization.

2. 31% of organizations are using AI to enhance workplace productivity, from automating tasks and surfacing insights to enabling faster content creation and summarization.

3. 24% are deploying AI to enhance customer service and self-service experiences.

Technology (77%) and financial services (72%) are doubling down on AI for insights and analytics, treating data as a competitive edge. Retail (77%), business services (75%), and healthcare (69%) are focused on AI-powered customer engagement. Meanwhile, use cases like search and information discovery are gaining ground across technology (64%), finance (66%), retail (71%), and business services (62%).

The survey also found that AI deployments take time to mature, typically 7 to 12 months, going from pilot to meaningful impact. This echoes Microsoft’s finding that most AI projects take up to 12 months to yield business impact.

Enterprise AI challenges: Why is Scaling Hard?

The majority of enterprises are already seeing early wins with AI. In fact, 93% of leaders report that their pilot projects met or exceeded expectations. However, moving from successful pilots to organization-wide AI transformation introduces a new set of hurdles.

The research suggests that enterprises are facing a few challenges that are slowing down their momentum. Some of these challenges are:

1. The AI talent gap - This remains the most significant challenge enterprises face today. Bain & Co. also identified that 44% of executives feel a lack of in-house expertise is slowing AI adoption.

2. High LLM costs - with 42% respondents citing it, ongoing token-based costs for LLMs also emerged as a significant challenge to scaling AI in the study. This suggests that usage-based costs become more relevant as organizations scale.

3. Data security and trust - 41% of the decision-makers in the survey reported that they face the challenge of safeguarding proprietary and first-party data.

Given these challenges, many organizations are rethinking their approach to AI adoption: Should they build custom solutions in-house, or is it more effective to buy? 👇

Buy or Build? Strategic Trade-Offs Shaping Enterprise AI

Let’s dive into the intriguing story revealed by Kore.ai research—the story of how enterprises are navigating the classic buy vs. build dilemma for AI.

The survey shows that enterprises clearly favor simplicity and speed over complexity. Only 28% of organizations said they’d prefer to build their own AI solutions from the ground up, while the remaining 72% are opting for various purchase-led strategies. This includes ready-to-deploy solutions (31%), customizable third-party offerings (25%), or integrating best-of-breed solutions (16%).

This trend is consistent with the McKinsey report, which says that AI strategies that combine vendor tools with internal capabilities enable enterprises to scale AI 1.5X faster than those building fully customized solutions.

Choosing Vendors: Value Over Cost

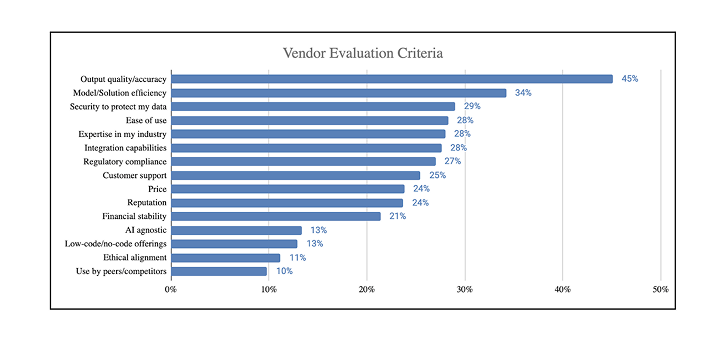

The choice of AI vendor is no longer just a procurement decision, but a make-or-break decision. Where the right partner can accelerate outcomes and scale innovation, while the wrong one can introduce friction, delays, and technical debt.

According to the research, decision-makers consistently prioritize output quality and accuracy (45%), AI solution efficiency and performance (34%), domain-specific expertise (28%), and ease of integration with existing systems (28%).

Notably, vendor pricing (24%) ranks much lower on the list. These priorities reflect a maturing market where leaders are looking for long-term partners that can evolve with their needs, understand their industry, and deliver measurable value at scale.

Want a complete breakdown of which buying strategies enterprises are using for AI? Download the full report for all details here.

Want a complete breakdown of which buying strategies enterprises are using for AI? Download the Full Report for all details.

What Are Hard-Earned Lessons From Past AI Projects?

As enterprise AI moves beyond pilots, leaders are asking hard questions: What really matters to scale? Where are we underprepared? And what can we improve? The research highlights critical areas that repeatedly emerge as the backbone of successful AI deployments:

1. Data Quality Is Imperative

More than 50% of the respondents cited data quality as an area needing serious improvement in future AI projects. After all, AI’s impact is only as strong as the data it learns from.

Industries such as retail, manufacturing, and technology are doubling down on first-party data, recognizing its role in enabling differentiated, AI-driven experiences. Meanwhile, regulated sectors such as healthcare, financial services, government, and business services are placing greater focus on the secure handling of client and third-party data.

2. Security And Data Privacy Are Non-Negotiable

With AI systems permeating enterprise operations, data security and privacy are more than technical boxes; they’re trust and compliance essentials. Nearly 40% of leaders view security and data privacy as the top area to strengthen in upcoming AI initiatives.

3. Tech Infrastructure Is A Strategic Enabler

Many organizations, in the survey, admit their current tech stacks aren’t built to support enterprise-grade AI. AI workloads demand significant compute power, scalable pipelines, and robust model governance.

4. AI Talent Is A Make-or-Break For AI Success

Kore.ai research suggests that almost two-thirds of organizations admit they need stronger AI expertise, but they’re divided on whether to hire new talent or upskill existing teams. The numbers underscore a broader talent crunch that affects every scale-up.

“AI success hinges on partnering data and business teams and building a data-literate culture.” - Vanguard’s Chief Data Officer.

Where Are The Investments Headed In 2025 And Beyond?

When asked, “How do you anticipate your AI budget will change over the next three years?” A remarkable 90% leaders say their AI budgets will increase, with 75% planning to allocate more than half of their IT spending to AI initiatives.

This upward trend is supported by an IBM study showing that, as of early 2025, AI spending had surged from 52% to 89% over the past three years.

The report also highlights industry-specific budget patterns. For instance, financial services and technology sectors are leading the charge with over 50% of their tech budget going towards AI technology. Business services and healthcare are following closely with substantial allocations, while manufacturing (25%) tends to be more conservative in its AI spending.

Final Thoughts: The Enterprise AI Story Is Just Beginning

If there’s one thing this research makes clear, it’s that AI is becoming a core part of how organizations work, compete, and grow.

The numbers tell a story that leaders are pushing beyond pilots, budgets are scaling fast, and AI is making its presence felt across departments, from customer support to finance to marketing. Talent strategies are evolving, infrastructure is being modernized, and data is finally getting the attention it deserves.

But the journey is far from over.

The research also highlights that while enthusiasm runs high, so do the expectations and the pressure to prove value, protect data, and scale responsibly. The decisions leaders make now, such as what to build, what to buy, where to invest, and how to measure success, will shape the trajectory of AI for years to come.

This blog only scratches the surface. The full Kore.ai Practical Insights from AI Leaders – 2025 report dives deeper into the benchmarks, strategies, and lessons that today’s decision-makers are using to turn AI potential into business performance.

Download the Full Report to uncover how leading enterprises are turning AI ambitions into real-world performance.