In the rapidly changing world where finance and technology intersect, data security has become of utmost importance. With the increasing use of chatbots and AI in banking, credit unions and call centers we are seeing improved efficiency and customer service. However, concealed within the depths of this technological surge are the data security challenges presented by chatbots, necessitating robust security measures to protect the most confidential financial information.

Security vulnerabilities can have serious consequences that should not be taken lightly and the costs of a security breach can be destructive to affected companies. The 2023 IBM Security Cost of a Data Breach Report,(1) showed the global average cost of a data breach reached $4.45 million in 2023 – an all-time high for the report and a 15% increase over the last 3 years. Detection and escalation costs jumped 42% over the same time frame.

Two chilling real-world accounts of data breaches with Delta Airlines and Samsung are stark reminders of the grave consequences when AI chatbot security falters.

Delta Airlines Chatbot Data Breach

In 2017, Delta Airlines fell victim to a severe data breach, a stark reminder of the vulnerabilities associated with AI chatbots. Hackers exploited weaknesses in Delta's virtual assistant chatbot services, resulting in the theft of customer payment data, passwords, credit card information, and email addresses. Delta Airlines took legal action against the AI firm responsible, citing inadequate security measures, including the absence of multifactor authentication, which allowed hackers to manipulate the chatbot's source code.

Samsung's ChatGPT Data Leak Debacle

In early 2023, Samsung faced a series of data leaks caused by inadvertent sharing of sensitive information with ChatGPT. Three separate instances were reported, with employees unintentionally revealing confidential data to the chatbot. In one instance, an employee pasted confidential source code into a ChatGPT conversation, while another shared code and requested optimization. A third employee shared a recording of a meeting for transcription purposes. Notably, information shared with ChatGPT is stored on OpenAI's servers and can potentially be used to improve the model unless users opt out, raising concerns about the exposure of private Samsung data to the public.

PCI DSS: Fortifying Financial Data Security

The Payment Card Industry Data Security Standard (PCI DSS) plays a pivotal role in preventing data breaches. Given the real-world implications and costs of inadequate chatbot security, let's explore how PCI DSS can be the shield that protects companies and their customers.

PCI DSS Unveiled

PCI DSS, or Payment Card Industry Data Security Standard, is the brainchild of major credit card companies, including Visa, MasterCard, American Express, Discover, and JCB of Japan. It's a comprehensive set of regulations designed to fortify the defenses of businesses that handle cardholder information. Think of it as the financial industry's ultimate security blueprint.

The Multi-Layered Armor

PCI DSS is the digital equivalent of a fortress with layers of defenses, from a moat to towering walls and vigilant guards. It mandates businesses to establish multiple layers of security that encompasses data storage, transmission, and access.

Data Encryption: The Digital Lock and Key

Encryption lies at the core of PCI DSS. It transforms sensitive data into an indecipherable code during transmission, ensuring that even if intercepted, it remains useless to prying eyes. This level of encryption is akin to having an unbreakable digital lock on your financial information.

Access Control: The Sentry at the Gate

Just like a fortress that only allows entry to those with the right credentials, PCI DSS enforces strict access control. It ensures that only authorized personnel can access sensitive cardholder data, creating a virtual security team monitoring the gates of your financial citadel.

The Bottom Line: Protecting Finances and Reputation

For businesses, complying with PCI DSS isn't merely about following rules; it's about safeguarding their reputation. A data breach can be catastrophic, leading to not only financial losses but also a loss of trust among customers. As we've seen through the Delta Airlines and Samsung data breach incidents, the stakes are high, and security must be a top priority.

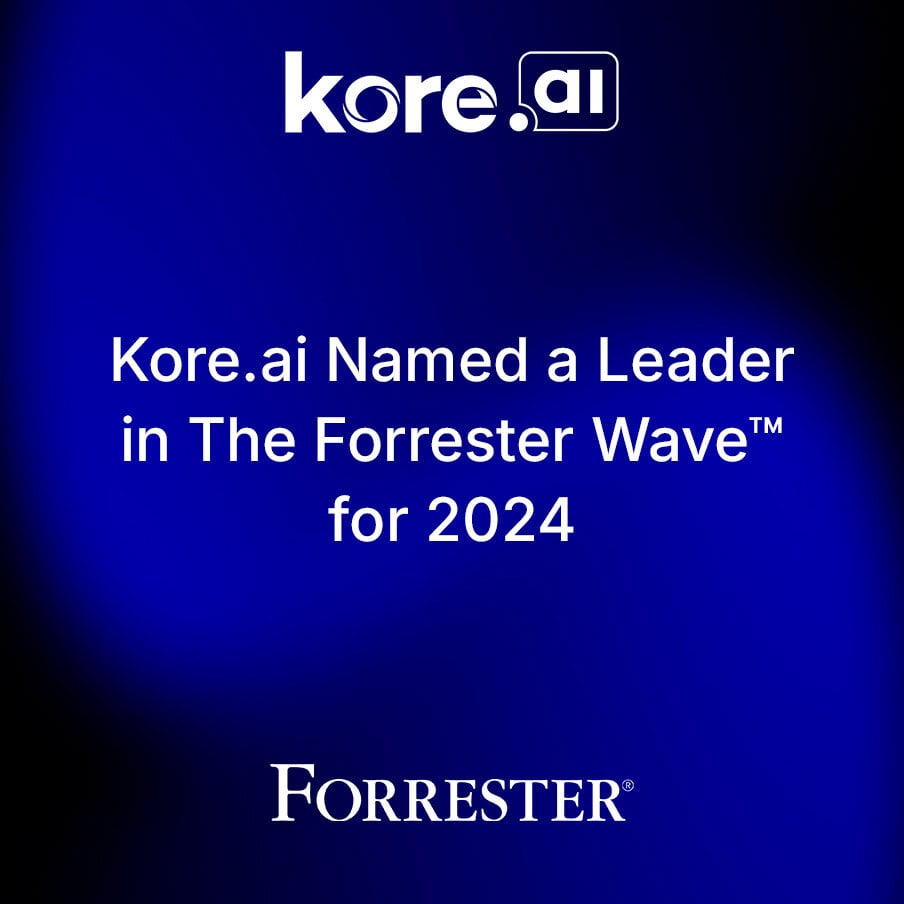

Kore.ai: Leading the Way in Chatbot Security

PCI DSS serves as a robust framework to address these challenges, ensuring that AI chatbots are fortified against data breaches. Kore.ai has achieved PCI DSS certification for our intelligent virtual assistant solutions built on the XO Platform. PCI DSS is renowned as one of the most challenging technical audits, known for its thorough and detailed examination.

Kore.ai's recent 2023 recertification for PCI DSS reaffirms a commitment to delivering secure and reliable AI chatbot solutions, ultimately protecting businesses and their customers in an era defined by data.

-1.jpg)

-1.jpg)

.jpg)