How Chatbots Can Drive Better Customer Engagement for Banks

As a digitally-savvy customer you expect your bank to deliver the best of its services to stay engaged. You want your bank to invest in your financial wellbeing, be your trusted partner in helping you reach your goals, discover news ways of conducting business efficiently, assist you in saving money and reward you for your loyalty. It’s a tall order indeed. But banks are having it tough to retain customers as it requires them to do a tight rope act. They are expected to deliver great customer service, build loyalty and fight competition – all the while keeping the cost of operations low. Luckily for them, technology has come in handy.

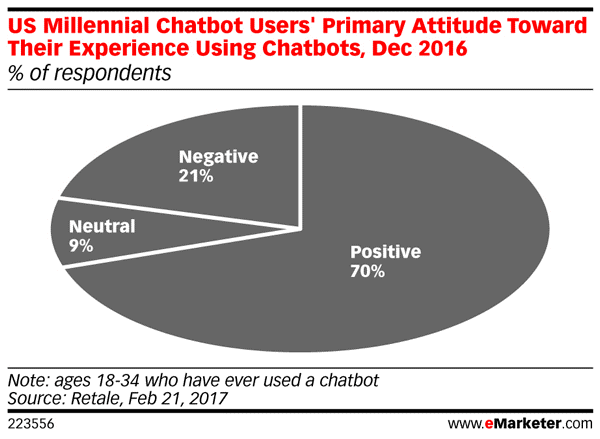

Chatbots are emerging as the preferred customer support platforms for financial services providers as they facilitate two-way communications with computers using natural language commands. Data suggests that 70 percent of customers prefer chatbot conversations with businesses as they can find answers to their questions much faster and the interactions much more seamless.

Also Read: Why Millennial Customers Are Pushing Banks To Take Digital Investments The Extra Step |

Banks place a great value on customer support as it’s a huge driver of customer satisfaction, ranking ahead of areas such as great products and services, brand recognition, trust, cost and innovation. In addition, cost savings that accrue through chatbots are too substantial to be ignored. It is estimated that problem resolution over the phone with live customer service agents ranges anywhere between $5 and $35 per call, while a live web chat costs around $3 per interaction. Chatbots that use human-to-machine interactions cost less than $0.50 per interaction and often deliver answers much faster than other engagement channels. Beyond being a less expensive engagement channel, chatbots also reduce—at a bare minimum of 10 percent—the number of support calls and chats a bank receives.

Meanwhile, because AI-powered, enterprise grade chatbots such as Kore.ai’s use machine learning, they learn back user habits and analyze trends. This helps your bank provide you advice on a massive scale and with better influence. According to Gartner, by 2020 fintech chatbots will become the norm as consumers will control 85% of the total business partnerships with banks through AI-powered chatbots.

Also Read: 5 Reasons you shouldn’t miss Kore.ai’s Webinar: Harness the Power of AI Chatbots in Banking |

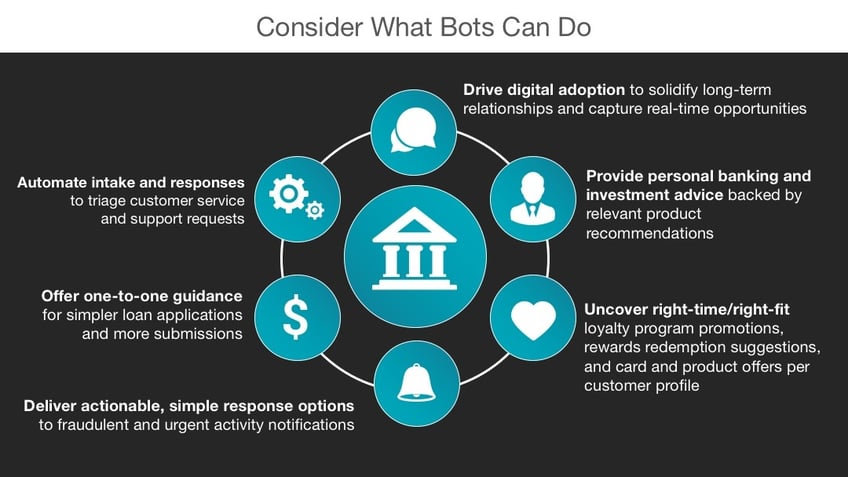

While there are a vast array of complex banking use cases that highlight the incredible capabilities of chatbots, here are our top 4 that you may find interesting:

- Chatbots as a Financial Advisor: Bots can act as your personal financial assistant by giving you advice on how to invest your money, what kinds of assets to buy and how to manage your expenses. Such bots help organize your life by saving time and efforts and provide you clarity and foresight by de-jargonizing complex finance terminology into plain commonsense.

- Bots for Doing Your KYC: As a customer, you may find it taxing to go through mandatory online processes that requires you to fill in details to ensure authenticity. AI chatbots as they are intelligent enough to assist you and inputs details at every stage of the process through a mobile or any other remote device.

- Bots that Assist in Fraud Detection: Chatbots act as helping hands in sending you push notifications proactively. These automated programmed notifications keep you updated about transactions done on your account in real-time. If it’s a fraud, you can also reply to the messages with pre-customized instructions to stop the transactions.

- Growing Customer Sessions: You may also get unsolicited marketing messages from chatbots. If you find it irritating, you can simply shut it out with ease without the fear of hurting anyone. A chatbot's not a human that carries a grievance or grouse. The good part is, the chatbot can do a good analysis of your customer sessions, read your likes and preferences and proffer the right products and services. Chatbots can be useful to spread good word of mouth to the customers.

Also Read: Now, More Than Ever, is Time for Banks to Adopt Conversational AI With Vigour |

The bottom line is, chatbots automate tasks, whether simple or complex. What’s important is that enterprises develop bots using a platform that is capable of developing both. With a truly enterprise-grade chatbots development platform, the possibilities of what a bot can do are endless. Such platforms could turn out to be the real holy grail of customer service excellence for both customers and bankers.