With the rise of digital technologies, the way we bank has changed - making it faster, easier, and more convenient for members and bankers but, unfortunately, also much less personalized. As banks and credit unions struggle to keep up with rising customer and member demands, they must also continuously create personalized member experiences in this new tech-centric world.

According to a study from J.D. Power, banking customers are financially stressed and want their banking providers to help them manage their finances digitally and with mobile apps - while providing personalized experiences. It can seem impossible to provide engaging member experiences while also increasing customer satisfaction, lowering agent turnover, and fighting overhead costs.

With the implementation of intelligent virtual assistants, banks and credit unions are able to automate up to 60% of business interactions while engaging members through natural conversation and offering personalized self-service options.

See how this Credit Union reduced Agent Call Volume by 24% in a Month!

How Banks and Credit Unions are Changing in a Digital Age

A survey from J.D. Power noticed that banking institutions are seeing a lot of volatility in customer satisfaction (CSAT) scores. Adding in heightened customer expectations for what a digital experience should look like creates additional ambiguity.

While technology is pivotal in the growth of digital banking – a trend that was accelerated by COVID-19 – there's still value to highly personalized, old-fashioned banking methods. Before mobile banking and ATM deposits, banking consumers engaged with their local branch for their monetary needs which created a financial community while building strong, trusting customer relationships. These personal interactions also allowed experienced bankers to offer additional financial services that benefited both the consumer and the institution.

Even though banking consumers could encounter delays or poor customer service, there was still a charm to this old-fashioned process that financial institutions can learn from. As technology advances and digital interactions become the norm for businesses, it is evident that banking consumers still need that personal touch from their financial institutions.

This makes traditional banking's most important benefit still relevant today: understanding the financial consumer and catering to their needs in a personalized way. Creating personalized digital interactions doesn’t have to be frustrating for banks and credit unions to implement. With the arrival of AI-based conversational interfaces, they can adopt digital technology in a much more efficient, user-friendly way while reducing service costs.

The Struggle of Creating Positive, Personal Banking Experiences

Financial institutions have some of the highest customer acquisition costs out of any industry. With the average customer acquisition cost (CAC) being above $300 and new customers costing up to 5 times more than keeping existing ones – it is essential to focus on creating positive banking experiences.

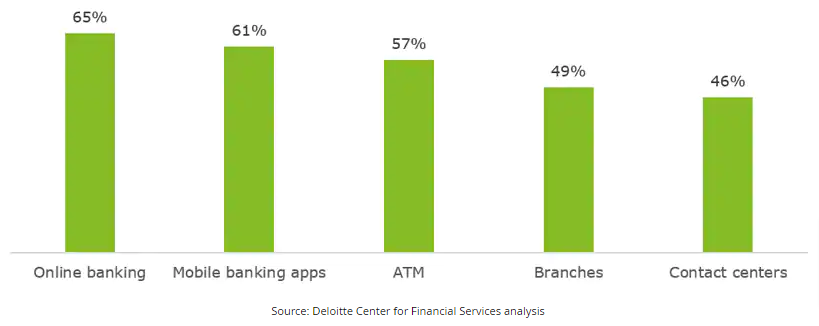

This is especially evident when looking at CSAT scores across industries, where customer satisfaction in banking contact centers is the lowest among all other banking channels. It’s no surprise that customers are exhausted with options like never-ending interactive voice response (IVR) system exchanges, repeated requirements to authenticate oneself, and constantly reiterating their problem to each new service representative they are transferred to.

These tiresome experiences coupled with increasingly high banking expectations make it tough to understand exactly what consumers want from a positive customer experience. With more big banks, credit unions, and online-only banking options than ever, consumers also have more options and less patience over a bad service experience.

The key to providing an exceptional banking service experience is through offering more personalized service that meets the needs for a variety of consumers on their preferred channel of choice. This means empowering banking consumers with the option to choose what channel will best suit them based on their current needs and situation. This means empowering banking consumers with the channel option that will best suit their needs based on what they’re doing. For example, a digital channel would be better-suited for a noisy environment or if the person is driving, a hands-free voice option would be preferred.

Creating this level of customer service without high overhead costs, is where Conversational AI comes in. Through intelligent automation and smart recommendations, all financial institutions of any size are able to improve their banking customer satisfaction while reducing service costs.

How This Credit Union Used Virtual Assistants to Increase Customer Satisfaction

As one of the largest credit unions in Metro Detroit, Public Service Credit Union has about 33,091 members and offers various banking and financial related services. With growth in member volume, they began noticing increasingly stressed staff, longer hold times, and concern with offering the same level of high quality service they are known for.

This credit union now faced a problem - they were unable to provide the quality of excellence in their customer service with increased call volumes which led to agent burnout and poor member experiences.

By implementing an intelligent virtual assistant (IVA), Public Service Credit Union successfully reduced the burden on their agents allowing them to focus more on outbound sales calls - without significant overhead costs. Choosing Kore.ai’s intelligent AI-based solutions - BankAssist and Smart Assist - made a positive impact on their member experiences. This has made their experience better and more seamless due to no waiting time and immediate resolution to member problems.

Leveraging this digital technology, PSCU was able to automate their contact center processes and reduce call volume by 25% and is now able to support a better, higher quality of service success.

Read more about this credit union's journey to better member satisfaction.

Implementing Your New Conversational Intelligent Virtual Assistant

Conversational banking is an extremely scalable solution that is secure and affordable for banks and credit unions of all sizes.

Digital and voice-enabled banking virtual assistants make it easy for banking consumers to manage their finances anytime, from anywhere. Unlike simple chatbots, these intelligent virtual agents can handle payments and transfers, credit card activation, password resets, pay alerts, reminders and other frequent, repetitive tasks. This frees up banking service teams to focus on more complex inquiries and boosts productivity.

Banking virtual assistants take financial institutions' automation to another level - allowing them to automate up to 60% of business interactions. Utilizing a banking virtual assistant allows you to carry out much more complex conversations than your average digital banking app, mimicking human conversation patterns. These AI-powered intelligent virtual assistants can draw from past chat history as well as current customer data in order to provide support that is tailored specifically for them. They are also equipped to handle a wide variety of customer and member questions and interactions related to their account or credit card, loan applications, new banking products, loyalty programs, and more.

Kore.ai’s BankAssist, a pre-built enterprise banking solution, provides customers with a simple, conversational way to understand and interact with their finances. Offer your banking consumers 24/7/365 self-service automation and agent assistance in the contact center that will create phenomenal experiences and build better relationships with your customers and members.