We’re quickly seeing financial institutions as the pioneers and early adopters of this technology. Those responsible for growth, customer experience, and digital strategies have grasped a real understanding of the potential chatbots hold. Too many companies have seen their past solutions fall short of breaking the barriers between institution and consumer, and fail to eliminate regulatory impediments.

Setting the Stage: Conversational Engagement

Like you, most leaders recognize the value of going digital and have embraced table-stakes technologies such as Internet banking and online applications. But, believe it or not, we are still at the forefront of the digital revolution. By 2018, McKinsey has estimated that as much as half of new financial services revenue come from digital channels, up from 10 percent in many sectors today. This growth accounts for nearly every aspect—from savings and term deposits to investments to accounts to insurance and pensions, and mortgages. The race is on to capture this business.

Yet, an alarming percentage of customers are dissatisfied with their digital experiences, and the numbers continue to go up. Less than half indicate they are happy with the services they receive, and only five percent report their sales and services experiences exceed expectations. Sixty-four percent even admit they have experienced rage as a result of a customer service issue. You read that correctly. Rage.

Still, with customer self-service proving 98% less expensive than channels requiring traditional human interaction, now is not the time to turn away from digital. In fact, it’s time to build upon the investment made to date. Leaving digital ‘to chance’ is risky business, with competitors popping up every day looking to scoop any dissatisfied customers.

Digital with a ‘Face’

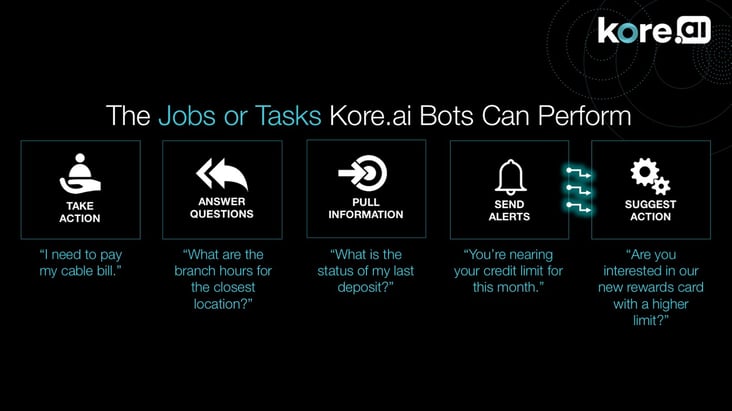

Chatbots hold the key for financial institutions to optimize digital—and offline—channels. Sustainable personalization for your customers is achievable. Consider a scenario where bots offer your customers:

- Conversational and personalized engagement

- New product and service offers for what they want, when they want it

- Less time spent on search-to-purchase

- Faster answers to product and service questions

- Automated basic support and on-demand human service at the moment of need

There are wins for your workforce also. Like virtual assistants, chatbots complete the routine tasks that eat away at the workday. Almost instantly, your staff can re-focus on the work that really matters by letting chatbots:

- Turn hard-to-use application UIs into simple messages

- Dramatically reduce time spent on daily administrative tasks

- Deliver relevant, timely, and personalized notifications

- Complete system tasks and pull information instantly

- Integrate workflows across disparate systems

Conversational engagement isn’t just a buzz word. It’s what customers and employees want. Leaders who can maximize the potential of chatbots will go a long way toward satisfying the growing needs on both sides of the business.

Watch our webinar: AI and Chatbot Must-Haves for Banking, to learn more.